The year began with optimism for a new decade that promised solutions to some of the industry’s biggest challenges. Concerns over the ‘Death of Retail’ or an ‘Apocalypse’ had given way to the expectation of a ‘Renaissance of Retail’ – offering more intimate, personal, human experiences to connect brands to communities. But what happens when your customers change their behaviors, establish new buying habits and adopt a very different set of priorities virtually overnight?

As design professionals, we’ve spent the past few months brainstorming and partnering with our clients to re-imagine the spectrum of retail spaces to better accommodate clients’ needs post-pandemic – these environments include, branch banks, supermarkets, beauty stores, apparel and the commercial mall. While we know the reality of the pandemic continues to evolve and that our design solutions will need to continue to adapt, we feel many of these low-cost ideas can provide long-term solutions.

We hope you’ll follow along with this series and look forward to partnering with you as we head to the future! First up, is Re-Imagining the Banking Experience.

Re-Imagining the Banking Experience

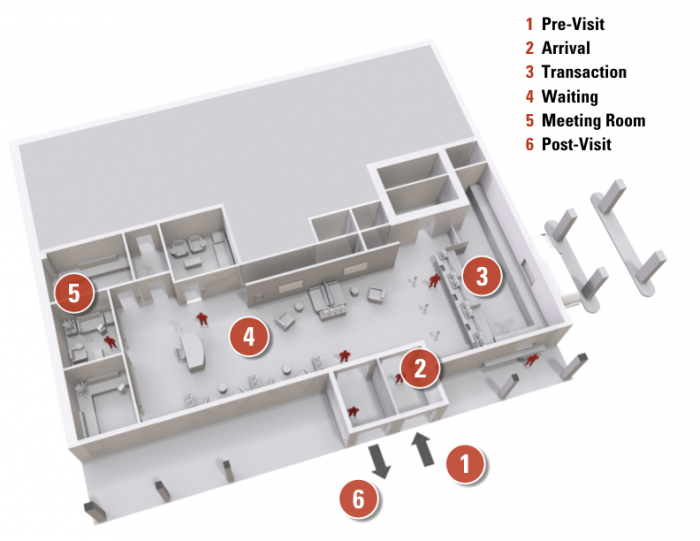

When exploring how the bank branch experience may evolve during and post-pandemic, it is helpful to explore solutions by putting yourself in the customer’s shoes. Focusing on the Customer Experience Journey allows us to look at new challenges and opportunities through a first-person perspective. This method of empathizing with the user provides a holistic look at the experience and helps us identify unique challenges and propose solutions that strengthen your connection with customers and employees by improving the overall experience for everyone.

Start by Putting Yourself in the Customer’s Shoes

When I am choosing a bank, two core factors in making that decision are trust and relationships. Whether I am making a deposit, taking out a loan or managing my investments, I need to know that I am getting the best advice and that my money is secure. The current pandemic creates tension for both areas as I navigate social distancing, wear a mask, and evaluate whether a place or an interaction is safe. As a customer, I need to know the amount of attention on my financial transactions is applied to the environment and personal interactions with the bank and its staff.

1) Consider the Pre-Visit Experience

I need to visit my local branch to discuss a loan, and I will also make a deposit since I’ll be at the branch. Before going, I check the app to see how busy they are and how many customers are waiting to be served. Thankfully, the branch isn’t busy and my transaction should go quickly. I also reserve a meeting room so that, after I make my deposit, I can talk with someone about the loan I need. The conversation should be quick and direct as I have already filled out a pre-meeting questionnaire that covers my specific needs.

2) What Happens Once I Arrive at the Bank?

Upon arriving at the branch, I see they now have teller access outside of the branch near the entry, allowing customers to make deposits without having to go inside. I see someone at the window with his dog, who just received a treat from the teller. Heading towards the entry, I see distinct entry and exit doors. As I enter, I pause for 3-seconds as a sensor takes my temperature and confirms there is enough capacity in the branch for me to safely enter. The app on my phone also confirms my arrival at the branch and notifies the staff. After the 3-seconds are up, and I am approved, the interior doors open and I am welcomed to the branch by a small digital sign.

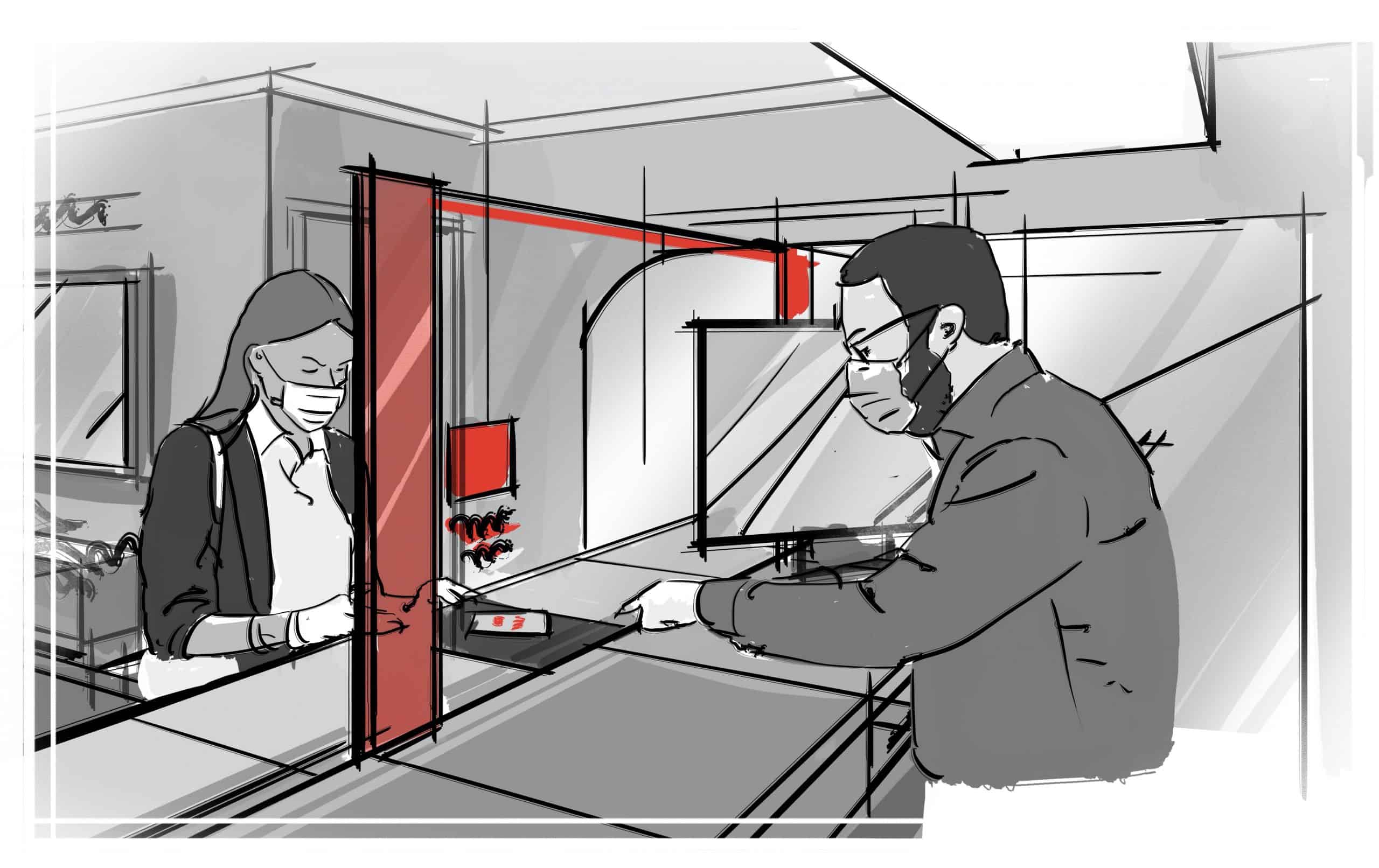

3) How are Bank Transactions Handled in a Post-COVID World?

Since nobody is waiting, the sign directs me to the 2nd teller where I am greeted by the teller on the other side of the glass screen. All items pass through a teller drawer using UV light to sanitize all items that pass from teller to customer and vice versa. My account information shows up on a small screen, and I use my app on the phone to provide a digital signature that approves my transaction.

4) Creating a Socially Distanced Yet Comfortable Waiting Experience

After my transaction is complete, the teller informs me that I can proceed to Meeting Room 4 once the screen next to the door is green. Right now, the Meeting Concierge is busy giving the room a final cleaning, so I take a seat in the spaced-out lounge seating. Next to the seating was a touchless water bottle refilling station, so I refilled my Nalgene bottle. The flat-screen in the waiting area provided a dashboard with the weather forecast for the next 5 hours, along with real-time air quality readings for both outside and inside the branch.

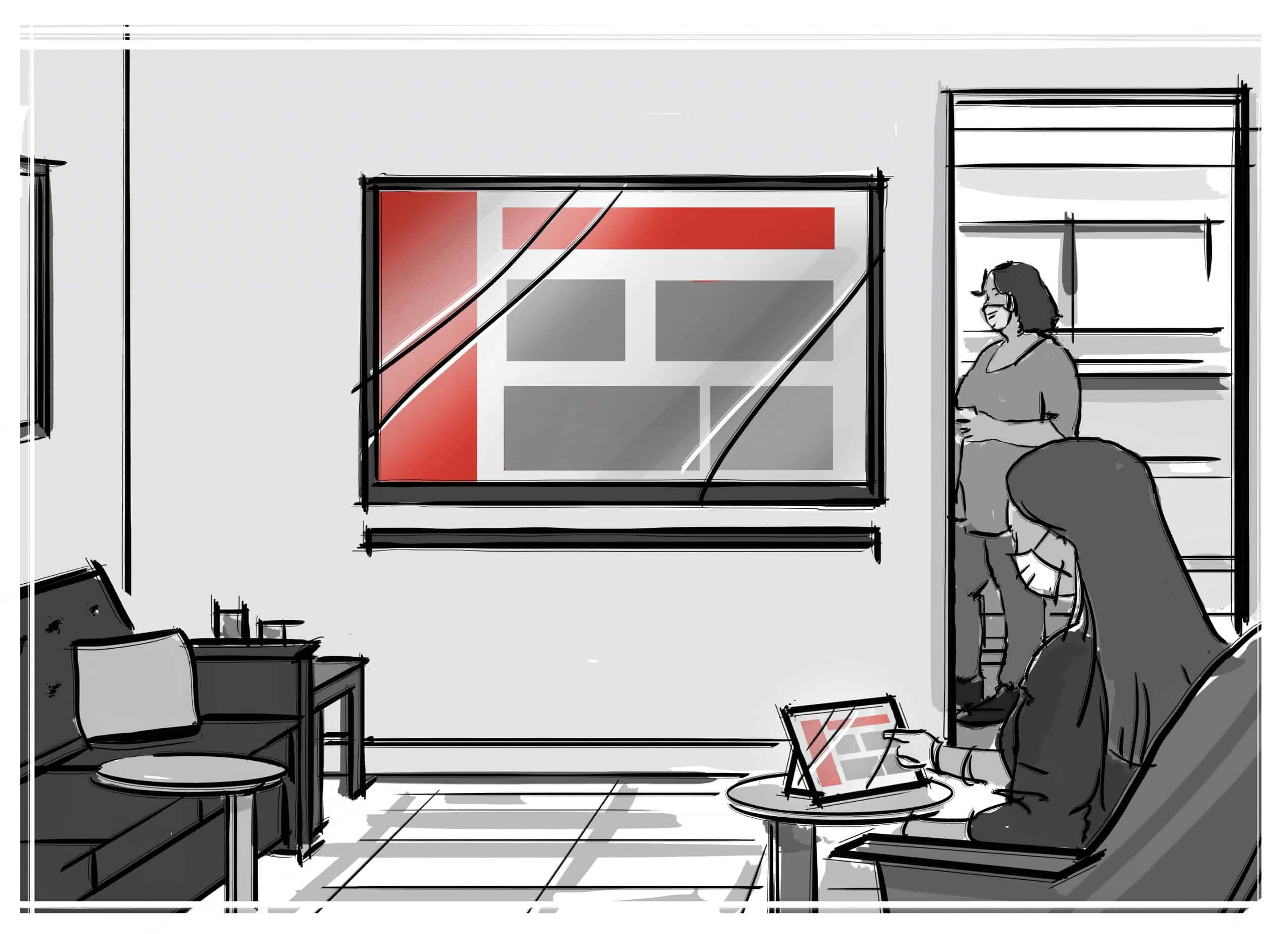

5) The Future of Retail Banking Meeting Rooms

After a few minutes, I notice the screen next to Meeting Room 4 is now green. As I approach the room, the Meeting Concierge greets me. I see that the green screen lists my name as well as the bank employee who I’ll be discussing my loan with. Upon entering the meeting room, I see that it is a nicely furnished room that feels like a hotel waiting room and includes a large touchscreen – much different from the bank offices of the past. It has a small coffee table and a nesting side table that I can use to set down my phone. I see that it has an integrated charger, so my phone charges as I wait for the employee to enter.

Once Sheila enters the room, we greet from a distance and she takes a seat with her laptop next to the large touch-screen. She is able to cast the information about my potential loan onto the flat-screen so that we can both see in the information at the same time. I appreciate that the screen is large since I am seated over six feet away from Sheila. After our conversation, instead of signing documents, I can digitally sign using the bank’s app on my phone and my phone as a touchpad. In my opinion, this is much better than having to touch a screen or a pen that has been touched by multiple people throughout the day.

After our meeting, I leave the room first and can see that the Meeting Concierge is preparing to clean Meeting Room 4 for the next customer. Sheila goes back into the private office section of the branch where she can work with privacy and not have to worry about her workstation getting contaminated by customers throughout the day.

6) The Post-Visit Experience (don’t forget to follow up!)

As I exit, I wave to the teller who helped me with the transaction earlier in my visit. I get a notification from my app thanking me for stopping by and asks for a quick rating as to my level of anxiety before and after my time at the branch. The app also notifies me that a copy of the signed documents has been sent to my email and also gives me the option to add Sheila’s contact information to the Contact List on my phone. For all of the negative ways that the pandemic has changed my life, my visits to the branch are now much more purposeful and positive. Overall, I think it has been a big improvement.