Stepping into the new year marks a perfect opportunity to rethink the spaces we design—how they function today and how they can evolve to better serve their purpose.

With declining foot traffic and the rise of digital banking, traditional bank branches are ripe for transformation. Most people can now manage their everyday banking needs from the comfort of their home without ever stepping inside a branch. But what if the future of banking went beyond transactions? What if branches became destinations that foster community, collaboration, and meaningful experiences?

A LOOK BACK: THE ROLE OF BANK BRANCHES IN HISTORY

For decades, bank branches all over the world were pillars of their communities. Architecturally grand, these buildings were designed to inspire trust and stability, often constructed with durable materials, soaring ceilings, and classical ornamentation. They weren’t just places to deposit checks; they were landmarks, status symbols of economic strength, and gathering places that reinforced the bank’s civic role.

But by the 1990s, the traditional bank branch began to decline. Economic pressures, regulatory changes, and advancements like ATMs and call centers reshaped how people accessed financial services. Many branches closed, though some of these once-monumental buildings still stand today—finding new life through adaptive reuse and serving fresh purposes.

Today, digital banking presents an even greater challenge to physical branches. The rise of online transactions and mobile banking has reduced the need for in-person visits. Meanwhile, the emergence of cryptocurrencies threatens to bypass banks entirely, enabling peer-to-peer transactions without intermediaries. These shifts don’t render bank branches obsolete, but they do demand a reimagining of their purpose.

Rather than fading into history, bank branches have an opportunity to evolve—transforming from transactional spaces into hubs of financial education, community engagement, and personalized service. The question isn’t whether branches will survive, but how will they adapt to meet the needs of a rapidly changing financial landscape?

BEYOND TRANSACTIONS: THE FUTURE OF BANK BRANCHES

For much of their history, bank branches prioritized efficiency over experience. Transactions were the focus, with little thought given to customer comfort or the emotional weight of financial decisions. Yet, financial anxiety is real—it stems from uncertainty, stress, cultural taboos, historical inequalities, and even something as simple as long wait times. Traditional bank environments, often cold and impersonal, only amplify this tension, reinforcing a power imbalance between institutions and customers.

Reimagining bank branches means addressing these issues through both design and customer experience. What if a bank wasn’t just a place for transactions but a space that actively eased financial anxiety? One of the few constants in our rapidly changing world is the human need for connection and trust, rooted in our social evolution and psychology. What if that became the foundation for the future of banking?

Some financial institutions are already leading the way, transforming their physical spaces into more inviting, multifunctional environments that blend financial services with lifestyle amenities. The Chelsea Groton Bank in Connecticut, designed by Little, showcases the potential of bank branches by transforming it into a destination for financial education and social interaction. Customers can enjoy a book in “The Knowledge Library”, a comfortable reading area for focused learning, and explore financial topics at their own pace. The design also incorporates spaces for casual conversations and tablets stationed throughout the space to facilitate independent learning.

COFFEE + BANKING = CAPITAL ONE CAFÉ

Capital One Café is redefining the bank branch by seamlessly blending financial services with a welcoming, café-style experience. With locations across the U.S., these spaces feel more like neighborhood coffee shops than traditional banks—offering customers a relaxed environment where they can grab a coffee, work remotely, or casually engage with banking services on their own terms.

At the heart of this transformation, there is a shift in customer experience. Instead of tellers behind counters, Capital One employs bank ambassadors, a rebranding that moves the interaction away from sales-driven transactions and toward meaningful financial guidance. Customers can explore self-service banking options, sign up for accounts with ease, or have a stress-free conversation about their financial goals.

Beyond daily banking, Capital One Cafés serve as hubs for financial education. They offer money coaching services, financial literacy workshops, and community events—all housed within an approachable, thoughtfully designed space. This inviting atmosphere not only reduces the intimidation often associated with banking but also increases foot traffic, proving that a well-designed, multifunctional branch can be more than just a place for transactions, it can be a destination for financial well-being.

COWORKING AT THE BANK OF MONTREAL

The Bank of Montreal (BMO) is reimagining the bank branch as a dynamic hub for business, networking, and wellness. At its urban campus in Toronto, BMO Place has embraced a coworking-infused banking model—offering entrepreneurs, small business owners, and remote workers a flexible space that goes far beyond traditional banking services.

Designed with functionality and well-being in mind, the space features coworking desks, private meeting areas, and event spaces where customers can collaborate, host networking events, or simply work in a professional environment. Unlike conventional bank branches, which often prioritize efficiency over experience, BMO’s design fosters comfort, productivity, and community engagement.

To further enhance the customer experience, wellness-focused amenities are seamlessly integrated into the space—acknowledging that financial health and personal well-being are deeply connected. Educational resources and advisory services are also available, ensuring that customers don’t just have a place to work, but also access to expert financial guidance.

Architecturally, BMO’s urban campus is a departure from the rigid, transactional bank spaces of the past. The design emphasizes openness, natural light, and flexible layouts, creating an atmosphere that is both inviting and functional. By blending financial services with coworking and wellness amenities, BMO is proving that the future of banking isn’t just about transactions—it’s about providing real value and meaningful experiences for its customers.

LUXURY MEETS BANKING AT DBS TREASURES CENTRES

DBS Treasures is redefining the high-net-worth banking experience by seamlessly integrating financial services with luxury hospitality. Headquartered in Singapore, these exclusive banking centers cater to affluent clients, offering a refined environment where wealth management is elevated beyond transactions to a truly personalized and relationship-driven experience.

Designed with a hospitality-first approach, DBS Treasures Centres feature warm interiors, sleek materials, and an atmosphere that feels more like a high-end lounge than a traditional bank. The architecture prioritizes privacy, comfort, and exclusivity, creating an environment where clients can discuss their financial goals in a setting that exudes sophistication and trust.

Beyond the design, DBS Treasures enhances the banking experience with tailored perks, including invitations to luxury lifestyle events, airport lounge privileges, and exclusive wealth education seminars. These events keep clients informed about market trends and investment opportunities while reinforcing the bank’s commitment to long-term financial growth.

By prioritizing one-on-one service and discretion, DBS Treasures fosters a deep sense of trust and exclusivity. This innovative approach proves that modern bank branches don’t have to be impersonal—they can be destinations of comfort, expertise, and luxury, where financial well-being is seamlessly integrated into an elevated lifestyle.

CROSS-INDUSTRY INSPIRATION: RETHINKING BANK BRANCH DESIGN

The evolution of bank branches offers a chance to rethink customer experience by drawing inspiration from industries like airport lounges, hospitality, and museums. By incorporating elements that prioritize comfort, engagement, and trust, architects can transform banking from a transactional necessity into a seamless, inviting experience.

Inspiration: Airport Lounges

Airport lounges have mastered the balance between comfort and exclusivity, offering travelers a tiered experience that banks can learn from. Imagine a bank branch designed with multiple functional zones, where customers are greeted at a concierge-style check-in desk and guided to a space tailored to their needs, all within a sleek, modern environment.

Design Elements:

- Zoned Experience: Self-service kiosks for quick transactions, coworking pods for members, and private consultation rooms for personalized financial discussions.

- Hospitality Touchpoints: Complimentary refreshments, refined seating areas, and a service approach focused on engagement rather than transactions.

- Premium Perks: Exclusive VIP lounges for clients, enhancing loyalty and deepening relationships.

By integrating these elements, banks can transform their branches into inviting destinations—spaces designed not just for transactions but for human connection, financial confidence, and trust-building.

Inspiration: Hotels

The hospitality industry thrives on personalized service, comfort, and attention to detail—qualities that can reshape the bank branch experience. A hospitality-inspired bank would focus on creating a warm, welcoming atmosphere that prioritizes both aesthetics and customer well-being.

Design Elements:

- Aesthetic & Sensory Appeal: A welcoming façade, warm statement lighting, biophilic design, ergonomic seating, soft carpeting, and calming scents.

- Personalized Service: A financial planning “menu” allowing customers to choose services tailored to their needs and loyalty perks like complimentary financial reviews, free workshops and after-hours networking spaces.

Community Integration: Dedicated space for local businesses to host pop-up shops, fostering engagement and driving foot traffic.

This model enhances personalization, strengthens emotional connections with customers, and reduces the tension often associated with financial planning. By making the banking experience feel as inviting as a luxury hotel, branches can retain high-value clients while reinforcing brand differentiation.

Inspiration: Museums & Galleries

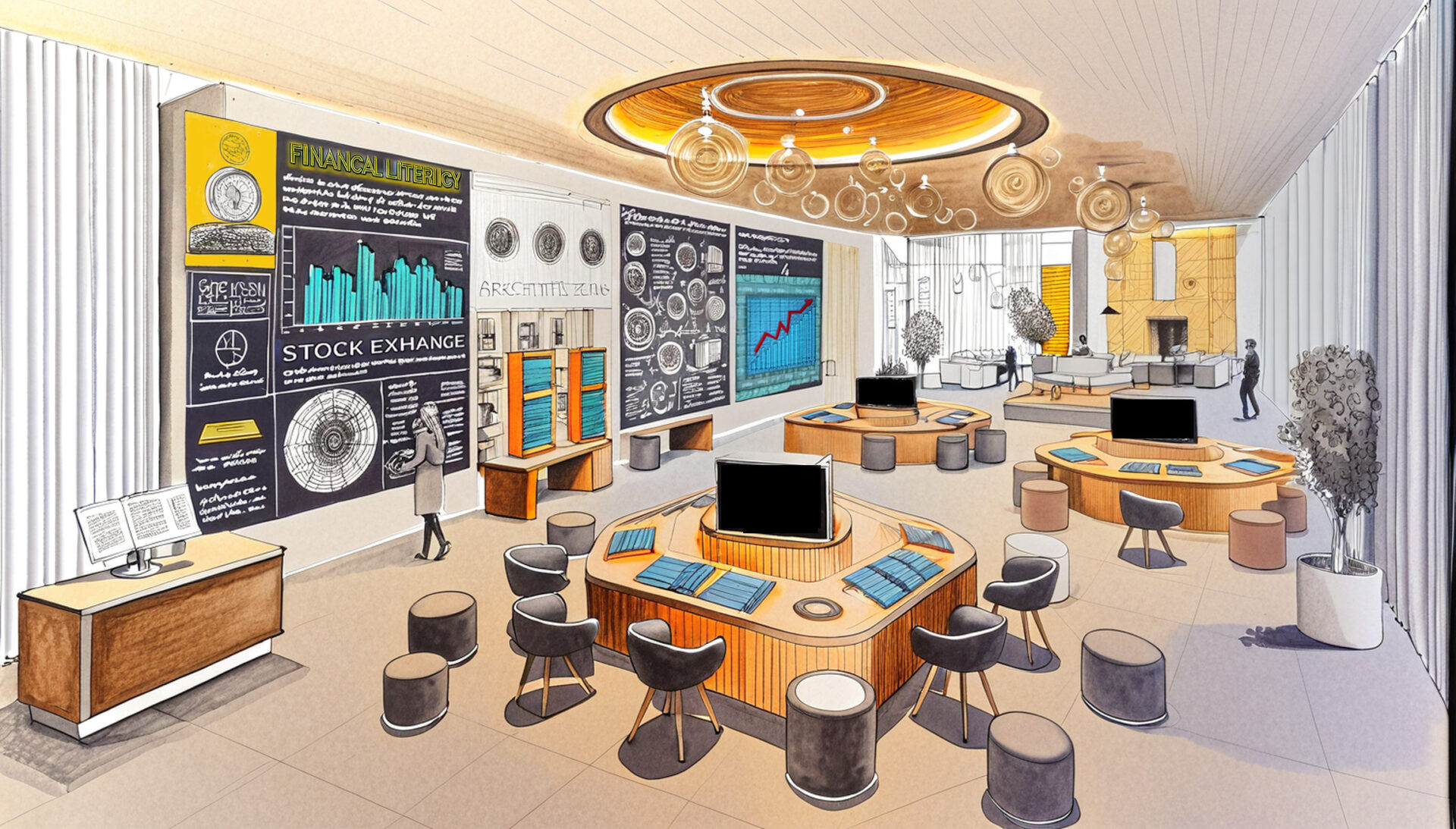

Museums and galleries inspire curiosity and engagement through storytelling and exploration. A bank designed with this approach would transform financial literacy into an interactive journey, inviting customers to discover financial concepts in a more immersive way.

Design Elements:

- Guided Introductions: Similar to museum tours, visitors could be introduced to banking services and promotions upon entry.

- Financial Literacy Exhibits: Themed zones with digital installations, interactive exhibits, and educational content on topics like the history of currency or investment strategies.

- Seasonal Engagement: Rotating financial planning sessions, tax workshops, and investment seminars to encourage repeat visits.

By aligning banking with education and discovery, this model fosters engagement, community integration, and financial empowerment. Customers leave not only having completed transactions but also with valuable insights that deepen their relationship with the institution.

CONCLUSION: A VISION FOR THE FUTURE

The decline of traditional bank branches is not an endpoint, but a catalyst for innovation. As the financial landscape evolves, so too must the spaces that serve it. By prioritizing social engagement, financial education, and personalized experiences, these reimagined spaces can become destinations that foster trust, connection, and well-being.