Grocery is at a critical pivoting point as consumers become more comfortable with emerging technologies and grocery delivery becomes more common. Both pre and post pandemic, consumers’ demand for convenience is at the forefront and the industry is ramping up to meet their needs. The COVID-19 pandemic has only accelerated the speed at which supermarkets have begun to integrate more technology within their business models. Some grocers have already taken the initiative to reevaluate existing platforms and consider delivery options that meet consumer needs for the quickest and easiest shopping experience.

With all these new technologies, what are the physical ramifications on the traditional grocery store?

Self-Checkout

Although there has been a major shift to e-commerce among consumers during the pandemic, the brick and mortar structure is not going anywhere. People still want to shop at a physical store for not only control of their purchases, but also for the instant gratification of having their goods now in lieu of waiting on them to arrive. Both pre and post pandemic, however, no one wants to wait in lines. Grocers have already implemented self-checkout options to enhance convenience by saving time during the purchasing process. Some are using new technologies to take checkout convenience to the next level.

Self-checkout was the first step in the technology revolution within the grocery store. Studies show that customers prefer self-checkout because they are faster and have shorter lines. They also find that the purchasing process is the most dreaded part of their shopping experience. Co-op and Amazon have not only improved the technology, they have eliminated the cumbersome checkout process all together. Co-op developed a checkout-free, pay-in-aisle technology that allows customers to scan items themselves and pay upon leaving using a mobile app. If scanning items is still too time consuming (or perceived to be), Amazon has taken this technology one step further with its “just walk out” approach. Depending on the type of grocery store, the space dedicated to checkout can vary from between 5-10% of a store’s sales floor square footage. Continuing to rethink the checkout process will not only give valuable time back to the customer, it will also return prime real estate back to the grocer.

E-commerce

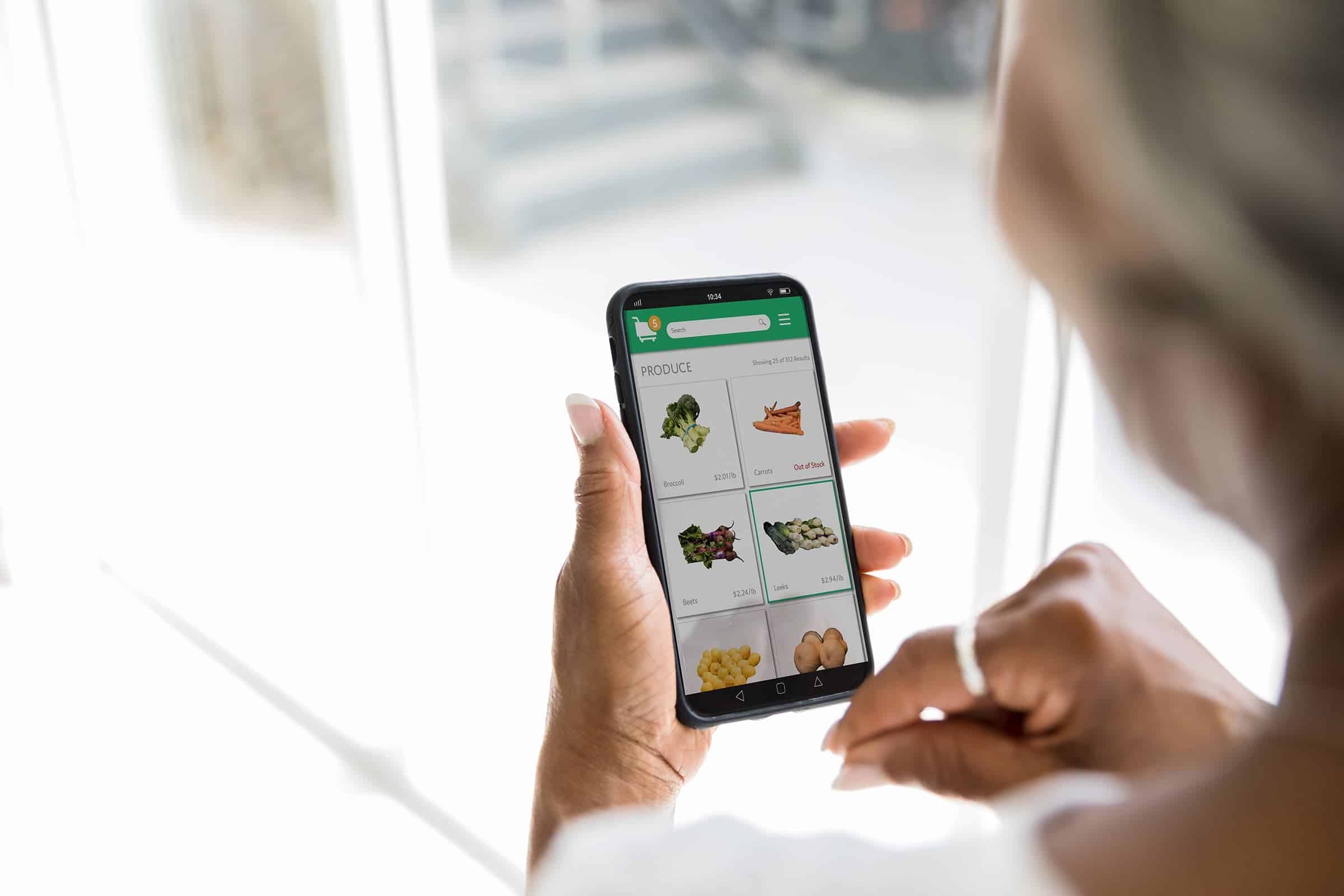

E-commerce has catapulted in popularity and acceptance due to the pandemic, with many people feeling more at ease shopping from anywhere and having their goods picked up or delivered. Using these online services has prompted more consumers to value the convenience of ecommerce over a trip to the store. As online shopping platforms evolve and become more user-friendly, navigating the ordering process and acceptance of online services can only grow. Grocers are finding new ways to make the online shopping experience better through intuitive operating systems and all-encompassing apps. If you’re already an avid online shopper, you likely have a go-to site or store that meets your shopping needs in the digital realm. If not, it’s just a matter of time before you will.

Convenience is the reason that online grocery sales have nearly doubled over the last six months. Grocers like Heinen’s have developed an all-in-one app for their customers’ online shopping needs. Partnering with Instacart, the app delivers much more than just the standard in app-offerings. Users can browse recipes, sales, and coupons, and keep their grocery list in a digital format with their shopping list builder. Having all these offerings within one app provides a digital experience that meets all the customers’ online needs. However, the growing demand for online shopping is having an adverse reaction on the physical store. To meet the needs associated with BOPIS (Buy Online, Pickup In-Store), grocers are having to retrofit existing stores by adding areas for staging and fulfillment. These staging areas are usually in unused spaces such as vestibules, along the front sales wall, and tucked in less desirable areas, with rows of lockers, coolers, and POS lined up waiting for the rush of orders. They are almost always crowded and create a pinch point that inhibits movement by the customer. Fulfillment and pickup in store require adequate space to run smoothly and not impede the customer’s shopping experience. Since online demand will continue to grow, reevaluating the supermarket floorplan to dedicate suitable spaces for online fulfillment must be a top priority versus an afterthought.

Fulfillment

A retailer’s ability to fulfill an order in a timely manner can be felt even before you walk through the door, with designated parking, curb side and in-store pick up areas becoming more commonplace in grocery stores. Grocers are integrating systems and technologies that give their consumer the option to pick up their orders or have them delivered. Same day service and a demand for fast turnaround has challenged the industry to seek better ways of meeting their consumers’ delivery needs.

Both Whole Foods and Kroger have created solutions to meet the growing demand for fast delivery. Amazon owned Whole Foods is focusing solely on delivery at their online only store in Brooklyn, New York. In lieu of having employees navigate the traditional busy store to fulfill an order, this store will not be open to the public. It will have a standard aisle layout for holding produce and refrigerated coolers for fresh produce, but no prepared food will be offered. Kroger is taking a different approach by launching an Ocado-Powered Customer Fulfillment Center. Ocado, who develops software, robotics, and automation systems for online retailers, will provide the technologies to streamline the fulfillment process, leading to faster order processing and completion. Speed and convenience for the customer are the driving factors behind both approaches but without the actual customer in the store, so the focus needs to shift to the employees using the space. With different goals than a customer shopping in a traditional store, the design should be adjusted so employees can fulfill orders in an efficient and timely manner while enjoying the space. New efficiencies in product placement, department adjacencies, movement through the space, and storage areas have adjusted the spatial layout for fulfillment centers, begging the question of how these solutions can influence the existing grocery store as technology shifts the grocery shopping experience.

Even though COVID-19 has thrown the grocery industry for a loop, convenience will remain a driving factor in shaping the grocery experience. Grocers must anticipate and adapt if technology advancements and online grocery shopping continues along its predicted growth trajectory. Space dedicated to e-commerce and delivery fulfillment will dominate the overall square footage of the store, eventually shifting the 80/20 customer to back-of-house ratio to 20/80. What grocers do with the remaining 20 percent will be what sets them apart in the industry.

* Please note: Portions in italics are extracted from Trend Hunter report.

Reference Documents:

7 Ways the Pandemic Has Changed Food Retailing

Kroger’s new Ocado centers are powerful. But can they deliver?

Kroger launches its first Ocado- powered ‘shed’, a massive robot- filled fulfillment center in Ohio

The Future of Checkout: How Retailers are Innovating the Payment Experience

Pandemic highlights the limits of store-based online fulfillment, experts say